does texas have a death tax

Already the District of Columbia has toughened its estate tax levy effective January 1 2021. The Texas Franchise Tax.

Death Penalty Law In Texas Houston Defense Lawyer Neal Davis

At that time TRS will request that a copy of the death certificate be provided when it becomes.

. After the homeowners death if the estate. Find the best ones near you. As noted only the wealthiest estates are subject to this tax.

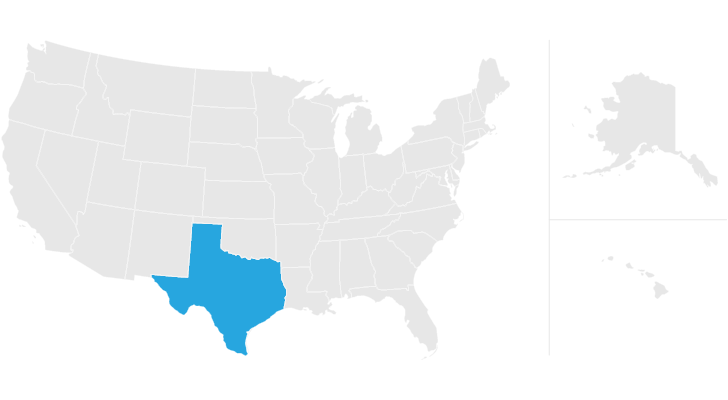

Texas is one of a handful of states that does not have an inheritance tax. So a married couple gets two step-ups one at the time of the first spouses death and another at the time of the second spouses death. If you die with a gross estate under 114 million in 2019 no estate tax is due.

No Texas does not have an estate tax for the time being anyway. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses.

The amount of tax depends on the value of your gross estate. 71 million Estate tax rates. For individuals who passed away between September 1 1983 and January 1 2005 a Texas Inheritance Tax Return must be filed.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. 600 AM on Feb 9 2020 CST. On April 21 2022 the State carried out its first execution in more than six months putting 78-year-old Carl Wayne Buntion to death.

108 - 12 Inheritance tax. The term death tax was first coined in the 1990s to describe estate and inheritance taxes by those who want the taxes repealed. The rate increases to 075 for other non-exempt businesses.

A fundamental feature of a Texas TODD is that like a will it has no effect during the. No there is currently also no inheritance tax in Texas for individuals who died on or after January 1 2005. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold.

Alaska is one of five states with no state sales tax. Although beneficiaries are responsible for paying the inheritance tax while estates pay the estate tax many estates step in to take this financial. At 183 compared that to the national average which currently stands at 108.

There is a 40 percent federal. As of 2022. Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed.

First choose your state. At the owners death a transfer on death deed conveys the real property subject to any mortgages liens or other encumbrances. Texas also does not have an.

Each are due by the tax day of the year following the individuals death. The owner can revoke it for any reason. The federal government imposes a tax on the transfer of your property at death.

The owner is also free to encumber the property. However localities can levy sales taxes which can reach 75. Due by April 15 of the year following the individuals death.

The State of Texas has executed 574 people since 1982. Texas Estate Tax. Tax is tied to federal state death tax credit.

Higher rates are found in locations that lack a property tax. UT ST 59-11-102. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million.

A federal estate tax is a tax that is levied by the federal government and that is based on the net value of the decedents estate. If your gross estate is over 114 million you pay a. Transfer on death deeds legal in Texas since 2015 have been heralded as the latest greatest method for keeping real property out of.

Prior to September 15 2015 the tax was tied to the federal state death tax credit. Death taxes are taxes imposed by the federal andor state. If an estate is worth 15 million 36 million is taxed at 40 percent.

Of these 279 occurred during the administration of Texas Governor Rick Perry 2001-2014 more than any other governor in US. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirsIt only applies to estates that reach a certain threshold. It is one of 38 states with no estate tax.

Yes Estate tax exemption level. That said you will likely have to file some taxes on behalf of the deceased including. In August Mayor Muriel Bowser signed the Estate Tax Adjustment Act reducing the exemption from.

Avvo has 97 of all lawyers in the US. Texas does not levy an estate tax. It has no effect until the owners death.

Then the estate must pay the taxes interest and penalties. Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and. It is a transfer tax imposed on the wealthy at death.

No Inheritance tax rates. There is no inheritance tax in Texas. What Is the Estate Tax.

For 2021 the IRS estate tax exemption is 117 million per individual which means that a. Final individual federal and state income tax returns. These federal estate taxes are paid by the estate itself.

The death tax can be any tax thats imposed on the transfer of property after someones death whether that tax is based on the total value of the decedents estate or the value of a single bequest. TRS may be notified by calling toll-free at 1-800-223-8778. A surviving spouse between the ages of 55 and 65 can keep the decedents exemption by applying at their local tax appraisal office.

Does Texas have a death tax on one that has died. Find a lawyer near you. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation.

You may have to pay federal estate taxes but not state inheritance taxes. Federal estatetrust income tax return. Does Texas have an inheritance tax.

TRS will require the name address and telephone number of a family member friend or other person who can act as a contact for TRS as well as the TRS participants date of death. The taxes plus interest plus a penalty keep adding up until the elderly or disabled homeowner dies. Find a lawyer by practice area.

The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use. However Texas does have the sixth highest property tax rate in in the US.

Can You File For Guardianship Without A Lawyer In Texas Guardianship Lawyer Attorneys

Ut Tt Poll Texans Stand Behind Death Penalty The Texas Tribune

:watermark(cdn.texastribune.org/media/watermarks/2012.png,-0,30,0)/static.texastribune.org/media/images/UT-TT-Poll-Thurs-LifeDeath-.128.png)

Ut Tt Poll Texans Stand Behind Death Penalty The Texas Tribune

Texas Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

1 Beatles Vintage Unused Full Concert Ticket 1964 New Orleans La Laminated Beatles Vintage The Beatles Concert Tickets

Texas Inheritance And Estate Taxes Ibekwe Law

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

2021 Residential Homestead Exemption Homesteading Harris County Real Estate Agent

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Negotiate A Lower Value For Tax Savings Negotiation Business Profile Texas Law

Report States With No Income Tax Get No Economic Boost Income Tax Income Charts And Graphs

Pin By Rich 704 On Charlotte Made Texas Governor Supportive Texas Cowboys